Discussion » Corporate green bond supply - implementation experience

Corporate green bond supply - implementation experience

We need scale to tackle climate change, which requires trillions of dollars in financing.

One driver and option for sustainability investment is provided by corporates which borrow from the financial markets the amount they need to implement projects with clearly defined environmental benefit. Such impact borrowing can be, for example, realised in form of green bonds.

My interest is particularly in corporate green bonds, and their possibility to finance environmental benefits across a corporate's supply chain. In a group of four, we recently presented results from a research project on green borrowing - the magnitude and determinants of the green bond supply and its heterogeneity across markets. We find that corporate green bond issue size appears volatile, with a tendency of decreasing over time. There is room for improvement for the issue size of USD bonds. Average maturity of bonds is constant and on average around 6 years. It will be interesting to observe second phase of green bonds as they mature. When is comes to issuer determinants of green bond issue size, corporations which are financially healthy (creditworthiness, debt/capital ratio) have more capability to issue green bonds. As there is a dominance by supranationals, more corporations with projects in large industrial and real estate sectors can be incentivised. There is a large potential for firms to issue bonds targeting international markets rather than being purely domestic.

>> From my experience of preparing green bonds in the industrial sector (waste to energy), it is quite challenging to create the project (i.e., to identify the offtaker) and finance the pre-project phase, even if finance of the resulting project is no issue. Has anyone of you previously looked at green corporate bond supply? It would be great to be able to discuss our results in more detail and include your implementation experience. Thank you for your inputs.

Demand for green bonds is surging: Institutional investors, such as Brown Advisory, Barclays, Andra AP Fonden, Calvert Research and Management on behalf of Calvert funds, Export Development Canada, Fjarde AP Fonden, Jupiter Global Ecology Diversified Fund, QBE Insurance Group, Mirova, Praxis Impact Bond Fund, State Street Global Advisors, Tredje AP Fonden, the California State Teachers’ Retirement System (CalSTRS), and others, are keen on lending with impact, yet the supply of opportunities for sustainability investment lacks behind the grand demand.

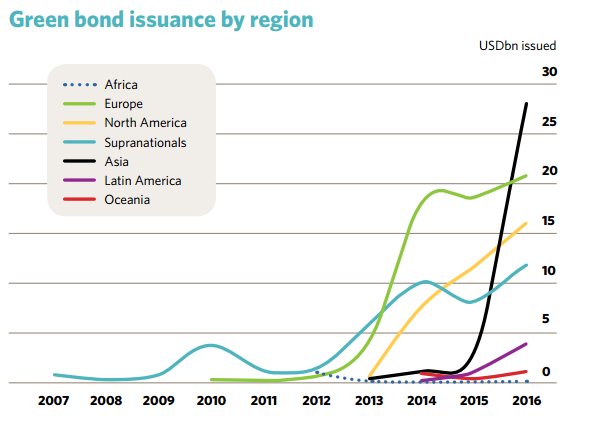

The following graph provides an overview of the history of green bond issuance across geographies, confirming that, so far, green bond issuance has traditionally been driven by multinational development banks (supranationals, starting in 2007). Just a couple of days ago, the newly launched USD 1 billion green bond issued by IFC was oversubscribed 2.6 times (see here).

However, green corporate bond issuance was the "biggest catalyst for market explosion in 2014" (see CBI here). In fact, in the same year, the first green asset-backed securities was brought to the market by Toyota (USD 1.75 billion). This bond showcased how proceeds from a bond backed by car leases and loans can be earmarked for future green vehicles. In 2017, Apple issued a USD 1 billion green bond to, among other things, finance renewable energy and energy efficiency at its facilities and in its supply chain. The company said the bond was meant to show that businesses are still committed to the goals of the Paris climate change accord (Reuters article). In 2016, the company had issued its first green bond, which at the same time was the first green bond issued by a technology company, backing projects on renewable energy for data centres, energy efficient and green materials. Its 7 year green bond amounted to USD 1.5 billion, the largest issued by a U.S. corporation. One of the projects it funded: a robotic system to dismantle ditched iPhones and salvage recyclable materials, such as silver and tungsten.

News & Discussions

.....For those who might be interested in the topic of "sustainability bonds", there was a webinar back in November for which the organisers (CFA Institute and Sustainalytics) have now shared the material and recordings --> here.

You may need to “register” if you haven’t already in order to view it. Enjoy, and perhaps share if/to what extent you found that information useful.

Thank you

Karin

0

FT covered this but was focused on Sean Kidney's concern over use of proceeds included in SEC guidelines. Litigation is feared was the negative trope.

Discussion » Corporate green bond supply - implementation experience

Corporate green bond supply - implementation experience

We need scale to tackle climate change, which requires trillions of dollars in financing.

One driver and option for sustainability investment is provided by corporates which borrow from the financial markets the amount they need to implement projects with clearly defined environmental benefit. Such impact borrowing can be, for example, realised in form of green bonds.

My interest is particularly in corporate green bonds, and their possibility to finance environmental benefits across a corporate's supply chain. In a group of four, we recently presented results from a research project on green borrowing - the magnitude and determinants of the green bond supply and its heterogeneity across markets. We find that corporate green bond issue size appears volatile, with a tendency of decreasing over time. There is room for improvement for the issue size of USD bonds. Average maturity of bonds is constant and on average around 6 years. It will be interesting to observe second phase of green bonds as they mature. When is comes to issuer determinants of green bond issue size, corporations which are financially healthy (creditworthiness, debt/capital ratio) have more capability to issue green bonds. As there is a dominance by supranationals, more corporations with projects in large industrial and real estate sectors can be incentivised. There is a large potential for firms to issue bonds targeting international markets rather than being purely domestic.

>> From my experience of preparing green bonds in the industrial sector (waste to energy), it is quite challenging to create the project (i.e., to identify the offtaker) and finance the pre-project phase, even if finance of the resulting project is no issue. Has anyone of you previously looked at green corporate bond supply? It would be great to be able to discuss our results in more detail and include your implementation experience. Thank you for your inputs.

Demand for green bonds is surging: Institutional investors, such as Brown Advisory, Barclays, Andra AP Fonden, Calvert Research and Management on behalf of Calvert funds, Export Development Canada, Fjarde AP Fonden, Jupiter Global Ecology Diversified Fund, QBE Insurance Group, Mirova, Praxis Impact Bond Fund, State Street Global Advisors, Tredje AP Fonden, the California State Teachers’ Retirement System (CalSTRS), and others, are keen on lending with impact, yet the supply of opportunities for sustainability investment lacks behind the grand demand.

The following graph provides an overview of the history of green bond issuance across geographies, confirming that, so far, green bond issuance has traditionally been driven by multinational development banks (supranationals, starting in 2007). Just a couple of days ago, the newly launched USD 1 billion green bond issued by IFC was oversubscribed 2.6 times (see here).

Source: CBI/HSBC 2016

However, green corporate bond issuance was the "biggest catalyst for market explosion in 2014" (see CBI here). In fact, in the same year, the first green asset-backed securities was brought to the market by Toyota (USD 1.75 billion). This bond showcased how proceeds from a bond backed by car leases and loans can be earmarked for future green vehicles. In 2017, Apple issued a USD 1 billion green bond to, among other things, finance renewable energy and energy efficiency at its facilities and in its supply chain. The company said the bond was meant to show that businesses are still committed to the goals of the Paris climate change accord (Reuters article). In 2016, the company had issued its first green bond, which at the same time was the first green bond issued by a technology company, backing projects on renewable energy for data centres, energy efficient and green materials. Its 7 year green bond amounted to USD 1.5 billion, the largest issued by a U.S. corporation. One of the projects it funded: a robotic system to dismantle ditched iPhones and salvage recyclable materials, such as silver and tungsten.

.....For those who might be interested in the topic of "sustainability bonds", there was a webinar back in November for which the organisers (CFA Institute and Sustainalytics) have now shared the material and recordings --> here.

You may need to “register” if you haven’t already in order to view it. Enjoy, and perhaps share if/to what extent you found that information useful.

Thank you

Karin

FT covered this but was focused on Sean Kidney's concern over use of proceeds included in SEC guidelines. Litigation is feared was the negative trope.

Can Apple's $1.5bn green bond inspire more environmental investments? | Guardian Sustainable Business | The Guardian